OUR SERVICE

Data-Driven Trade Decision in Africa

In today’s rapidly changing global trade landscape, accurate data is the core competitive advantage for companies seeking to enter or expand in new markets

By tracking African’s full-year customs import data and combining it with in-depth sectoral analysis, we provide actionable market intelligence that enables informed and executable business strategies

Whether you are a local African enterprise or an overseas company aiming to enter the African market, our data tracking service helps you quickly identify high-potential products, suppliers, and customers

Questions We Help You Answer

Market Size & Growth Trends

- What is the total import value/volume of your product in the region?

- How has it grown or declined year-on-year and month-on-month?

- Are there notable seasonal fluctuations?

Supply Chain & Country-of-Origin Landscape

- Which countries are the top suppliers, and how have their market shares changed over time?

- Which new countries are entering or exiting the market?

- How do regions (e.g., Asia vs. Middle East vs. Europe) compare in market presence?

Performance of Key Product Segments

- Which HS4/HS8 subcategories are growing the fastest?

- What are the import volumes, average prices, and supplier concentration levels for each segment?

- What are the product differentiation characteristics (e.g., premium vs. mass market, raw materials vs. finished goods)?

Pricing & Competitive Intelligence

- What are the price levels and trends for different supplier countries or vendors?

- Is the market driven by low-price competition or high value-added opportunities?

- Are there signs of policies favoring local processing or import substitution?

Market Entry & Expansion Opportunities

- For local clients: Which products currently rely on imports and lack mature domestic production?

- For overseas clients: Which sectors offer price advantages or have low technical barriers to entry?

- How do policies, tariffs, and non-tariff barriers impact market entry strategies?

2024 Kenya Import Market Insights

As East Africa’s economy continues to expand, Kenya, positioned as a regional trade hub, is experiencing a steady transformation in its import structure. This evolution reflects the combined effects of industrial upgrading, changing consumer patterns, and shifts in the global trade landscape. Import data from 2024 reveals several notable trends:

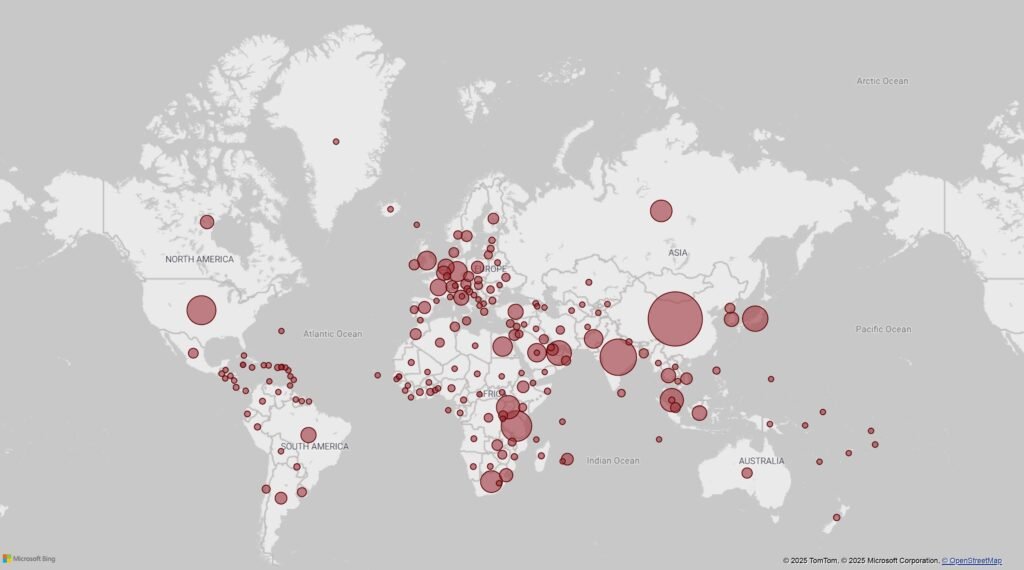

Trade Partner Landscape

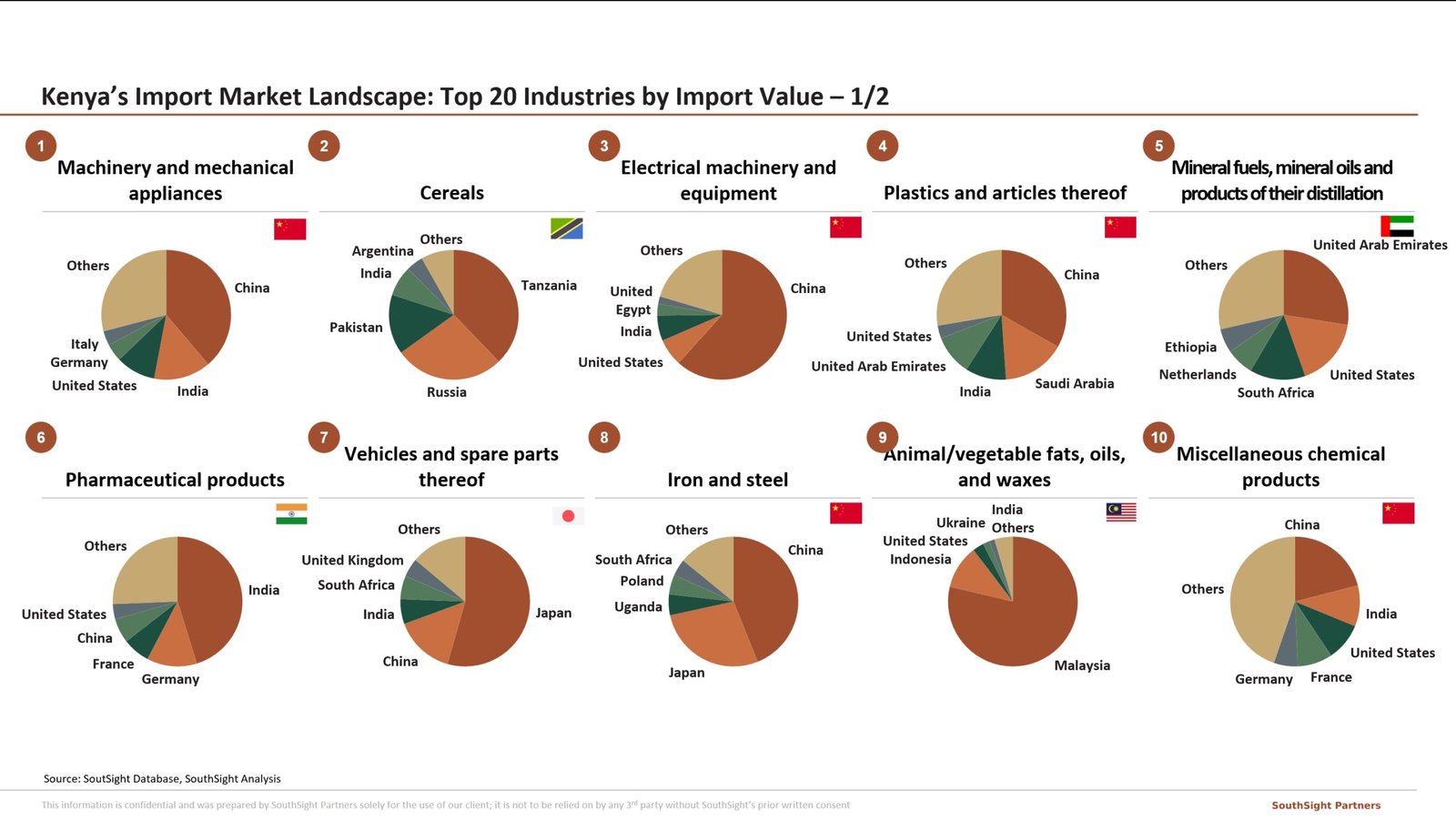

- Among countries with more than 4% share in Kenya’s import value, China, India, the United States, Japan, and the UAE rank as the top five non-African partners; Tanzania, as a neighboring country, enters the top three overall

- The overall pattern forms a diversified supply network centered on Asia and the Middle East, with significant contributions from neighboring African economies

- China and India dominate in machinery, electronics, and chemicals; the US and Japan have a competitive edge in high-end machinery and medical equipment; the UAE serves as a key re-export hub

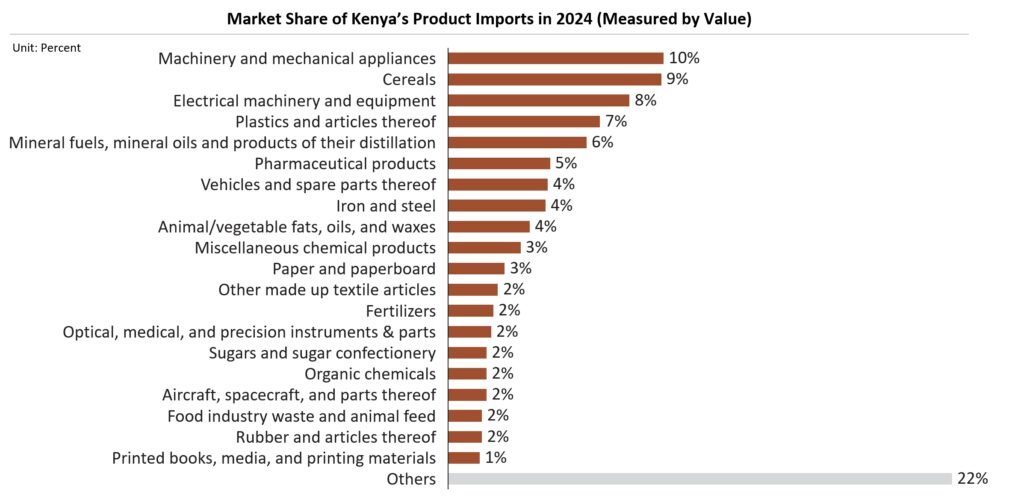

Industry Composition

- Machinery & mechanical appliances,

cereals, electrical machinery & equipment, plastics, and mineral fuels

make up the top five import categories, accounting for over 39% of total

import value

- This composition highlights that

infrastructure development, manufacturing growth, and food security remain

central to Kenya’s economic agenda

- The portfolio spans from heavy-duty

equipment for large-scale projects to critical raw materials for

production and consumer goods

Key Demand Drivers

1. Ongoing Infrastructure Development

- Machinery and mechanical appliances rank first in import value, including engineering and construction equipment. Under the Belt and Road framework, road, railway, port, and power infrastructure projects continue to expand

- Iron and steel remain essential for structural and industrial facilities, with strong demand for plates and sections

- Vehicles and spare parts – particularly for construction and transport – are boosted by urban road upgrades and public housing projects

2. Manufacturing Upgrading Fuels Equipment & Raw Material Demand

- Growth in imports of industrial production equipment (Computer Numerical Control machines, packaging lines, food processing machinery) supports capacity expansion in textiles, food processing, and construction materials

- Plastics, chemicals, and animal/vegetable oils & waxes are critical inputs for packaging, building materials, and food manufacturing

- Steel serves not only in infrastructure but also in industrial fabrication

3. Digitalization Drives Electronics & Electrical Equipment Imports

- Electrical machinery and equipment ranks third, covering telecommunications, power systems, consumer electronics, and industrial automation

- Investments in telecom infrastructure continue, including 4G expansion, 5G trials, fiber optic deployment, and data center development

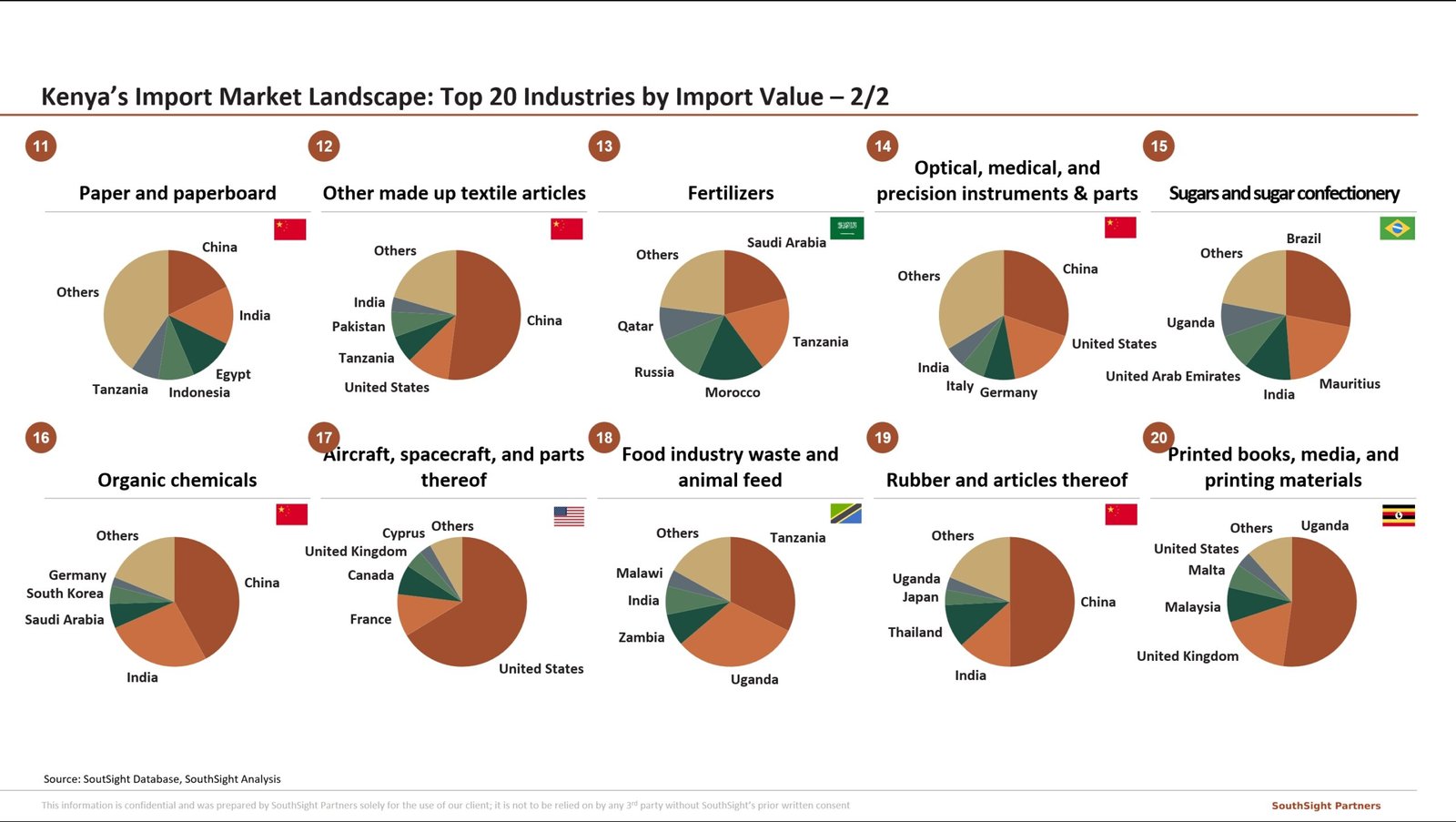

- Imports of precision instruments and medical devices are on the rise, enabling healthcare digitalization and advanced manufacturing quality control

4. Urbanization & Population Growth Boost Consumer Goods Demand

- Cereals rank second, reflecting high dependence on imports for staple foods such as wheat, rice, and maize

- Pharmaceutical products show stable growth, driven by population expansion and increased health awareness

- Demand for sugar & confectionery, paperboard, rubber products, and printed materials is rising, fueled by food processing, e-commerce logistics, and retail packaging needs

Conclusion

Kenya’s 2024 import profile reflects a dual momentum of infrastructure & industrial upgrading alongside digital and consumer market expansion. Businesses targeting the Kenyan market should align strategies with government investment priorities, industrial transformation pathways, and demographic trends to capture emerging opportunities